Traditional debt collection methods, often manual and time-consuming, struggle to keep pace with the dynamic financial landscape. Generative AI, with its automation and data-driven insights, offers a compelling alternative.

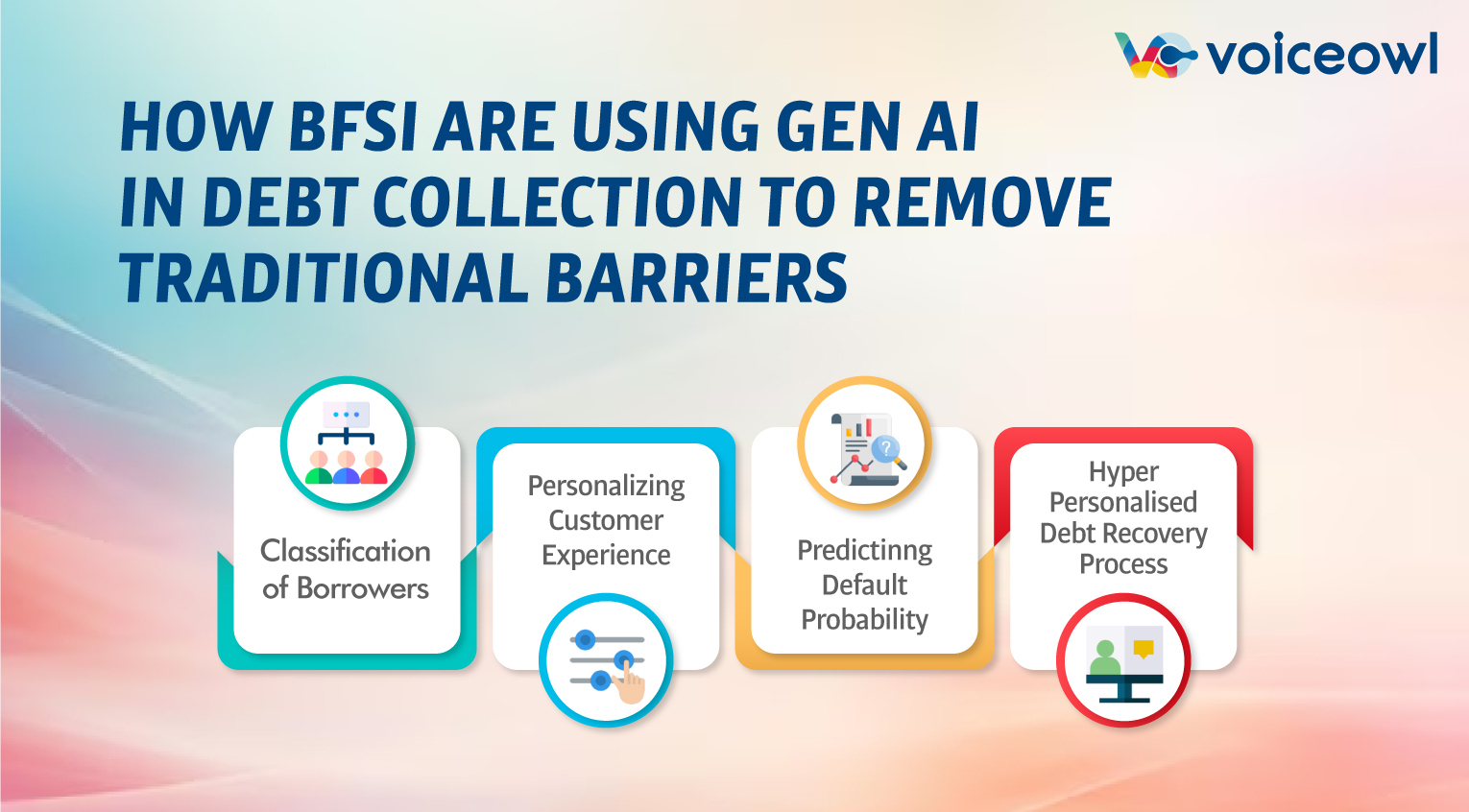

Here’s how AI in debt collection is revolutionizing BFSI approach to lending and debt collection:

- Enhanced Communication:

- Personalized Outreach: AI-powered virtual assistants and chatbots seamlessly engage borrowers across various platforms, fostering personalized communication at scale. Imagine voice AI virtual assistants tailoring messages based on individual preferences, sending reminders at opportune moments, or even adapting communication styles for a more natural interaction.

- Omnichannel Engagement: AI-powered automation transcends limitations of traditional channels, reaching borrowers on their preferred platforms like email, SMS, social media, and more. This ensures timely message delivery and increases the likelihood of response.

- Streamlined Processes:

- Automated Workflows: Gen AI-powered solutions automate repetitive tasks, freeing up human resources for more strategic endeavors. Imagine automatically sending invoices, generating personalized repayment plans, or even initiating collection calls based on predefined criteria.

- Seamless Integration: Gen AI-powered automation platform seamlessly integrates with existing systems, streamlining data exchange and eliminating manual data entry. This fosters operational efficiency and reduces errors.

- Deeper Customer Insights:

- Comprehensive Profiling: GenAI-powered automation platform analyzes data from diverse sources, painting a holistic picture of each borrower’s financial situation. This includes credit history, debt obligations, and even spending patterns, enabling targeted outreach and personalized debt recovery strategies.

- Predictive Analytics: Gen AI-powered algorithms identify potential defaulters early on, allowing you to implement proactive interventions and prevent delinquencies. This not only mitigates losses but also fosters positive borrower relationships.

- Optimized Strategy Development:

- Data-Driven Decisions: Gen AI in debt collection analyzes historical data to identify patterns and trends, informing optimal collection strategies. This includes tailoring communication styles, selecting the most effective channels, and even predicting repayment behavior.

- Dynamic Adaptation: AI-powered virtual assistants continuously learn and adapt, ensuring your strategies remain relevant and effective in a constantly evolving environment.

- Modernized Analytics:

- Advanced Data Aggregation: AI aggregates data from diverse sources, providing a comprehensive view of your debt collection operations. This empowers informed decision-making and facilitates data-driven optimization.

- Actionable Insights: Gen AI in debt collection extracts valuable insights from complex datasets, highlighting bottlenecks and opportunities for improvement. This empowers you to fine-tune strategies and maximize collection success.

The Tangible Benefits of AI in Debt Collection

Implementing AI in debt collection yields significant advantages, including:

- Improved Payback Rates: Gen AI-driven insights and personalized outreach lead to higher repayment rates, minimizing losses and boosting profitability.

- Reduced Insolvencies: Proactive risk identification empowers you to prevent defaults before they occur, minimizing financial risks and protecting your bottom line.

- Enhanced Customer Experience: AI-powered communication fosters a more positive and personalized experience for borrowers, improving customer satisfaction and loyalty.

Real-World Examples of AI in Action (Use Cases):

The transformative power of AI in debt collection is evident in practical applications across various industries:

- Automated Alimony Collection: AI-powered platform automates phone calls for alimony collection, ensuring timely communication and improved recovery rates.

- Chatbot-Driven Debt Management: Voicebots and chatbots, assists customers with debt management, offering personalized guidance and payment options.

- AI-Powered Credit Scoring: AI-powered automation platform utilizes AI to assess creditworthiness, enabling informed lending decisions and effective debt collection strategies.

VoiceOwl: Context AwarePurpose Built Native Generative AI Platform For Enterprises

VoiceOwl’s automation solution leverages the transformative power of Generative AI, enabling intelligent, automated conversations at scale.

This empowers collection agencies to overcome the industry’s core challenges:

- Right-party Contact (RPC): Identifying and connecting with the correct individual is crucial for efficient recovery. VoiceOwl’s AI virtual assistants excel at establishing RPC with high accuracy, ensuring the right conversations reach the right people.

- Automation: Repetitive tasks like payment reminders and initial inquiries can bog down agents. VoiceOwl automates these interactions, freeing up agent bandwidth for complex cases and personalized engagement.

- Cost Reduction: Traditional methods incur significant call and personnel costs. VoiceOwl’s highly scalable Gen AI automation solution dramatically reduces costs per call, making recovery more efficient and affordable.

The VoiceOwl Advantage

Beyond core functionalities, VoiceOwl offers a comprehensive suite of features designed to optimize every aspect of debt collection:

- Configurable Collection Rules: Tailor automated interactions to specific debt types, collection stages, and consumer profiles.

- Compliance Filters: Adhere to stringent regulations like (DPDPA, GDPR, etc.) with compliance ready AI automation and real-time updates.

- Detailed Dashboards & Reports: Gain comprehensive insights into portfolio performance and agent activity.

- Secure Data Exchange: Ensure data privacy and security with robust encryption and access controls.

- Seamless Agent Transfer: Escalate complex calls to live agents for personalized intervention.

The Impact: Measurable Results and Industry Recognition

VoiceOwl’s impact transcends technological innovation. Here’s how it translates into benefits:

- 100% Account Penetration: Reach every debtor within minutes, maximizing recovery potential.

- Enhanced Customer Experience (CX): Personalized, respectful interactions improve debtor sentiment and collection success.

- Accelerated Revenue Recovery: Faster call processing and higher collection rates lead to quicker cash flow.

- Improved Collection Efficiency: Reduced costs and optimized workflows boost overall agency performance.

- 100% Compliance: Minimize legal risks with adherence to all relevant regulations.

Embracing the Gen AI in Debt Collection Advantage with VoiceOwl

AI is no longer a futuristic concept; it’s a readily available tool with the potential to revolutionize debt collection. By embracing its power, you can unlock significant benefits, enhance operational efficiency, and foster positive customer relationships. Take the first step towards a transformed debt collection experience with VoiceOwl today and unlock the competitive edge your business deserves.